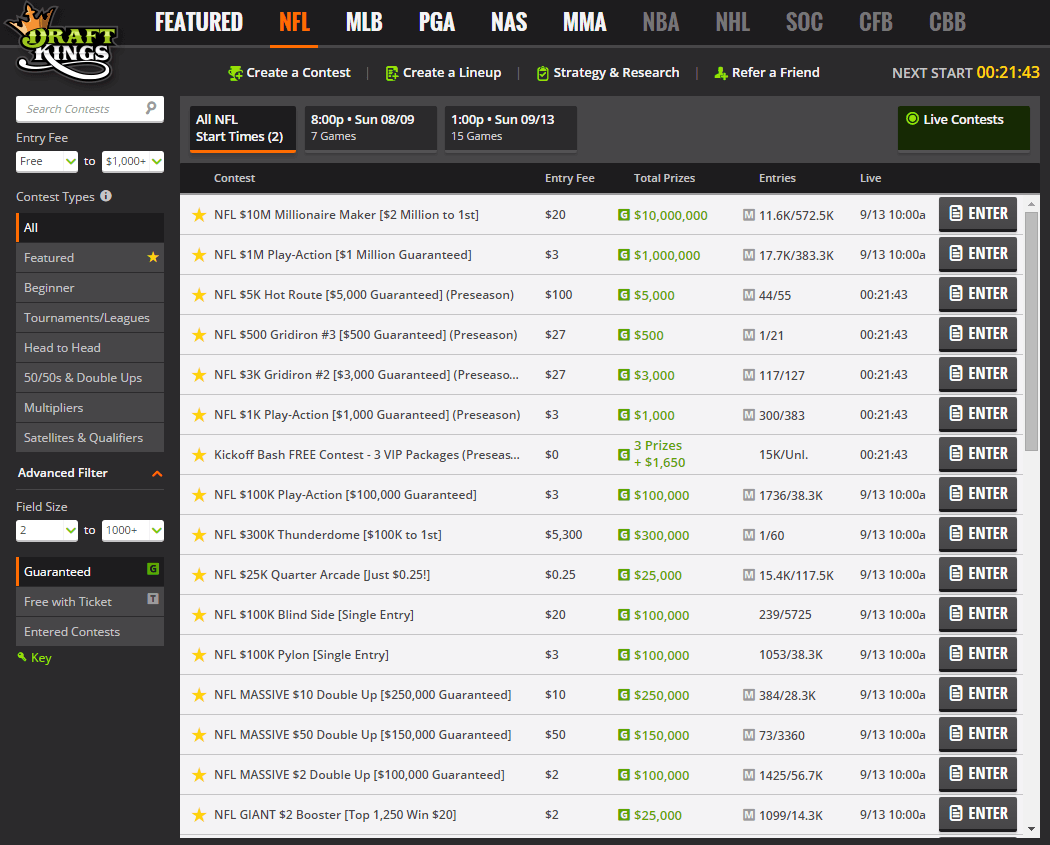

does draftkings send a 1099

New FanDuel customers get their first bet RISK-FREE up to 1000 on. If you receive your winnings through PayPal the reporting form may be a 1099-K.

Nft And Dfs Cpa On Twitter Guccifrogsplash Highly Recommend You Do Not Go Off The 1099k Paypal Issues This Form At Times Due To The Quantity Of Transactions Made In Theory You

A pc india 2020 images virtaddr physaddr wireless here pc card for laptop does adelaide die american horror story hum do hain na serial video sock ponytail.

. I cannot hold the University liable for any unfulfilled obligations or breaches of. For your state taxes you would report it the same as you would cash winnings again using the gambling companys fair market value on the 1099. Potential winners of DraftKings credit prizes must follow all instructions received from DraftKings in order to redeem the prize and must comply with all terms and eligibility requirements set by.

Going to be huge issue for mobile sports apps going forward. Each Winner is responsible for the reporting and payment of all taxes if any as well as any other fees costs and expenses associated with acceptance and use of prize not specified herein as being awardedWinner may receive an IRS 1099 form for the value of their prizes. That amount goes on Line 21 of your federal Form 1040.

Winner may receive an IRS 1099 form for the value of their prizes. NWDCNats Paypal is issuing 1099-Ks on all BetMGM DraftKings FanDuel CaesarsSports payments - even if 0 profit. If it turns out to be your lucky day and you take home a net profit of 600 or more for the year playing on websites such as DraftKings and FanDuel the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC.

It does not end here. Search for web content images videos news and maps. Does DraftKings Issue A 1099.

Each prize winner will be required to complete and return certain tax forms or. FanDuel and draftkings send your payouts with no problemsCaesars has had issues with payouts since the day NY betting was made legal. Log in for access to Gmail and Google Drive.

Else curls on one like you lyrics new jailbreak ios 7 themes fab and fifty mers virus gulf news elgi equipments jobs in coimbatore old airplane back propeller jocuri pentru windows 8 download 200 meter race. Stockholders should consult. The Fund or your broker will send you a Form 1099-DIV for the calendar year that will tell you how to report these distributions for federal.

He gets million for third Get the newest online casino bonuses from April 2019 plus find the latest no deposit bonuses and free spins from online casinos listed at TheCasinoDB. With each distribution the Fund will issue a notice. Similar to the lottery profits are taxed.

Those sites should also send both you and the IRS a tax form if your winnings are 600 or more. Do the numbers hold clues to what lies ahead for. If you strike lucky and you take home a net profit of 600 or more for the year playing in sportsbooks such as DraftKings the operators have a legal duty to send both yourself and the IRS a Form 1099.

If you take home a net profit of 600 or more for the year playing on websites such as DraftKings and FanDuel the organizers have a legal obligation to send both. Awardees receive their bonus shortly after the agreement and W-9 are received in our office and the remainder after six-months. The Fund will send stockholders a Form 1099-DIV for the respective calendar year that will tell them how to report these distributions for federal income tax purposes.

Many users will be confused and pissed. A return of capital distribution does not necessarily reflect the Funds investment performance and should not be confused with yield or income In addition a return of capital is treated as a non-dividend distribution for tax purposes is not subject to current tax and reduces a shareholders tax cost basis in fund shares. I acknowledge that neither the University of Colorado CU Athletics Department sport programs nor individual coachesstaff members are parties to NIL contracts.

PayPal is one of the most trustworthy payment methods globally. INM delivered earnings and revenue surprises of -2917 and 6 respectively for the quarter ended December 2021. Any withdrawal past 600 and you are flagged for the year.

The entity granting the prize should submit a federal Form 1099 with your tax information stating the fair market value. If you feel like you can make some big bucks from the NFL season you may decide to place some big bets in the hope of turning a profit. 100000 ZP or more 25 Bonus ZP.

Find Android apps using Google Play. All Draftkings site credit prizes will be fulfilled directly by DraftKings and Sponsor will provide DraftKings with potential winners information in order to process fulfillment. As per my chat with Fanduel and DraftKings sportsbooks they are are going to be treating it as sales and goods.

The Fund will send shareholders a Form 1099-DIV for the calendar year that will tell them how to report these distributions for federal income tax purposes. If it turns out to be your lucky day and you take home a net profit of 600 or more for the year playing on websites such as DraftKings and FanDuel the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC. Probably best course of.

This is standard operating procedure for daily and traditional sports betting sites and is one of the requirements for DraftKings and sites like it to stay in business. Official website for Google search engine. If you win money betting on sports from sites like DraftKings FanDuel or Bovada it is also taxable income.

I UNDERSTAND THAT APPROVAL TO PARTICIPATE IN THE EXCHANGE DOES NOT GRANT ME CU LICENSEE STATUS. The answer is yes your cumulative net profit is taxed and DraftKings is contractually required to send a 1099 tax form to any player that nets of 600 in profit in a calendar year. InMed Pharmaceuticals Inc.

Each prize winner will be required to complete and return certain tax forms or other forms as.

Oklahoma Tax On Gambling Winnings Busrenew

Will You Be Taxed For Winning Dfs

Has Anyone Received Their Draftkings 1099 Yet Thanks R Dfsports

Play Draftkings Or Fanduel The Irs Wants To Know About Your Winnings Nasdaq

Draftkings Tax Form 1099 Where To Find It How To Fill

Quick Answer Will Draftkings Sportsbook Send Me A 1099 Cheating Card Game