lincoln ne sales tax calculator

Lincoln NE Sales Tax Rate The current total local sales tax rate in Lincoln NE is 7250. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023.

Lincoln To See New Sales Tax Revenue Starting October 1

Department of Revenue Current Local Sales and Use Tax Rates.

. S Nebraska State Sales Tax Rate 55 c County Sales Tax Rate. Maximum Possible Sales Tax. Average Local State Sales Tax.

The Nebraska state sales and use tax rate is 55 055. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. 45 sales tax in Dawes County.

Average Local State Sales Tax. The December 2020 total local sales tax rate was also 7250. The Nebraska state sales tax rate is currently.

This is the total of state and county sales tax rates. Maximum Local Sales Tax. Find your Nebraska combined.

This includes the rates on the state county city and. Sales Tax in Lincoln Nebraska is calculated using the following formula. Sales Tax Rate s c l sr.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax. Nebraska State Sales Tax. The base state sales tax rate in Nebraska is 55.

Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. The current total local sales tax rate in Lincoln County NE is 5500. Sales tax in Lincoln Nebraska is currently 725.

Nebraska State Sales Tax. Lincoln NE 68509-4877 Phone. Nebraska Sales Tax Rate Finder.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska. Maximum Possible Sales Tax. For a 20000 purchase.

The average cumulative sales tax rate in Lincoln County Nebraska is 583 with a range that spans from 55 to 7. For a 20000 purchase. The December 2020 total local sales tax rate was also 5500.

This is the total of state county and city sales tax rates. You can use our. Sales Tax Chart For Lancaster County Nebraska.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Usually the vendor collects the sales tax from the consumer as the consumer makes a. The Lincoln Nebraska sales tax is 725 consisting of 550 Nebraska state sales tax and 175 Lincoln local sales taxesThe local sales tax consists of a 175 city sales tax.

The sales tax rate for Lincoln was updated for the 2020 tax year this is the current sales tax rate we are using in the Lincoln Nebraska. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 645 in Lancaster County. The Nebraska sales tax rate is currently.

A Base Tax set in Nebraska motor vehicle statutes is assigned to the. The minimum combined 2022 sales tax rate for Lincoln County Nebraska is. Method to calculate Lincoln sales tax in 2021.

Maximum Local Sales Tax. The minimum combined 2022 sales tax rate for Lincoln Nebraska is. 8 sales tax in Gage County.

The Nebraska state sales and use tax rate is 55 055.

California Sales Tax Small Business Guide Truic

What S The Car Sales Tax In Each State Find The Best Car Price

The 10 Least Tax Friendly States For Middle Class Families Kiplinger

Corporate Tax In The United States Wikipedia

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

Washington Sales Tax Rates By City County 2022

Nebraska 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Nebraska Tax Application Form 20 Fill Out Sign Online Dochub

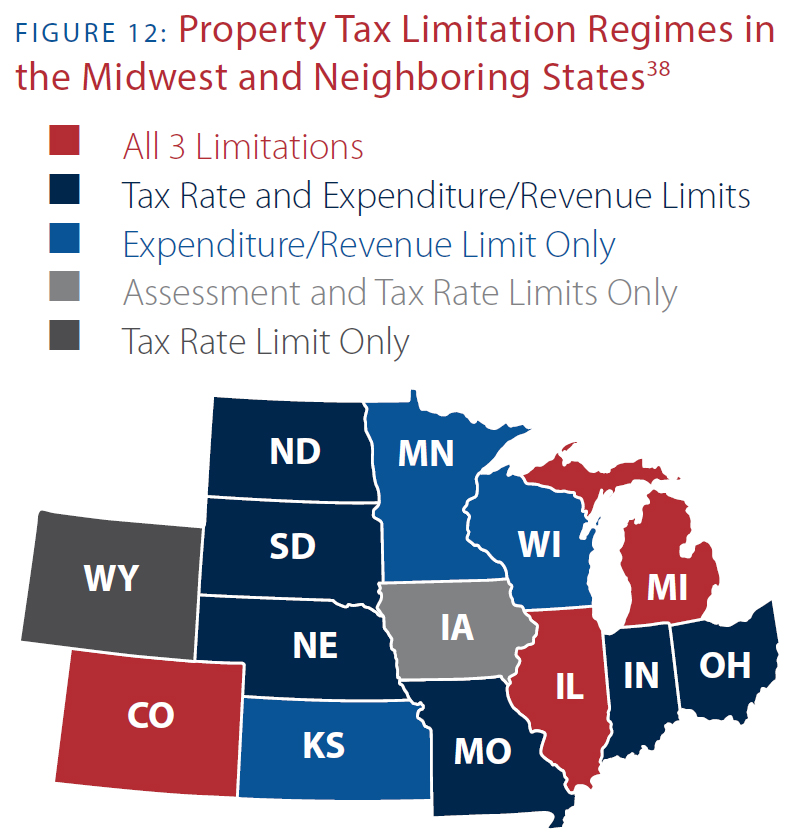

Property Taxes By State Which Has The Highest And Lowest

Here S What Happens To Your Sales Tax Gobankingrates

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

New Truth In Taxation Postcards Creating Confusion For Property Taxpayers In Lancaster County

Sales Use Tax South Dakota Department Of Revenue

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Nebraska Income Tax Ne State Tax Calculator Community Tax